The only way to prevent extensive damage from Phoenix Financial Services to your credit report is to remove its entry as soon as you can.

#Pendrick capital partners phoenix financial services how to

How to remove Phoenix Financial Services from your credit report Most debt collectors have complaints against them, but Phoenix Financial Services certainly has more than the average. The majority of these complaints are concerning harassment, failure to validate debts and inaccurate reporting, all of which violate the Fair Credit Reporting Act (FCRA) and the Health Insurance Portability and Accountability Act (HIPAA). There are roughly 950 complaints filed with the Consumer Financial Protection Bureau (CFPB) and over 300 with the Better Business Bureau (BBB).

It may show up on your credit report under various names, including:ĭespite only being six years old, Phoenix Financial Services has a significant number of complaints. It specializes in collecting debts from things like medical bills, student loan debts and government obligations. I have never received a bill or any prior collections notice for this at any time in past and there has been nothing reported to my credit report- which I make an active effort to keep clean.Originally founded in 2014, Phoenix Financial Services is a small debt collection agency out of Indianapolis, Indiana. Because of the age of your debt, the creditor cannot sue you for it. This disclosure applies to the account(s) noted with (*): The law limits how long you can be sued on a debt. There’s a little * star by the account and on the bottom of the letter says:

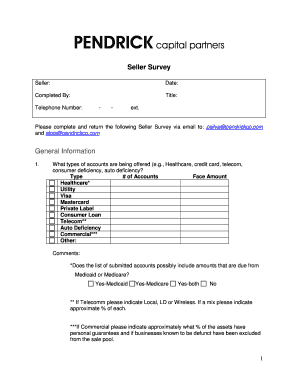

I have no idea what this debt is but apparently it’s something medical related from mid 2018. Received a notice from Phoenix financial services who are trying to collect for another collections agency- Pendrick Capital Partners- who got it from the “original creditor”.

0 kommentar(er)

0 kommentar(er)